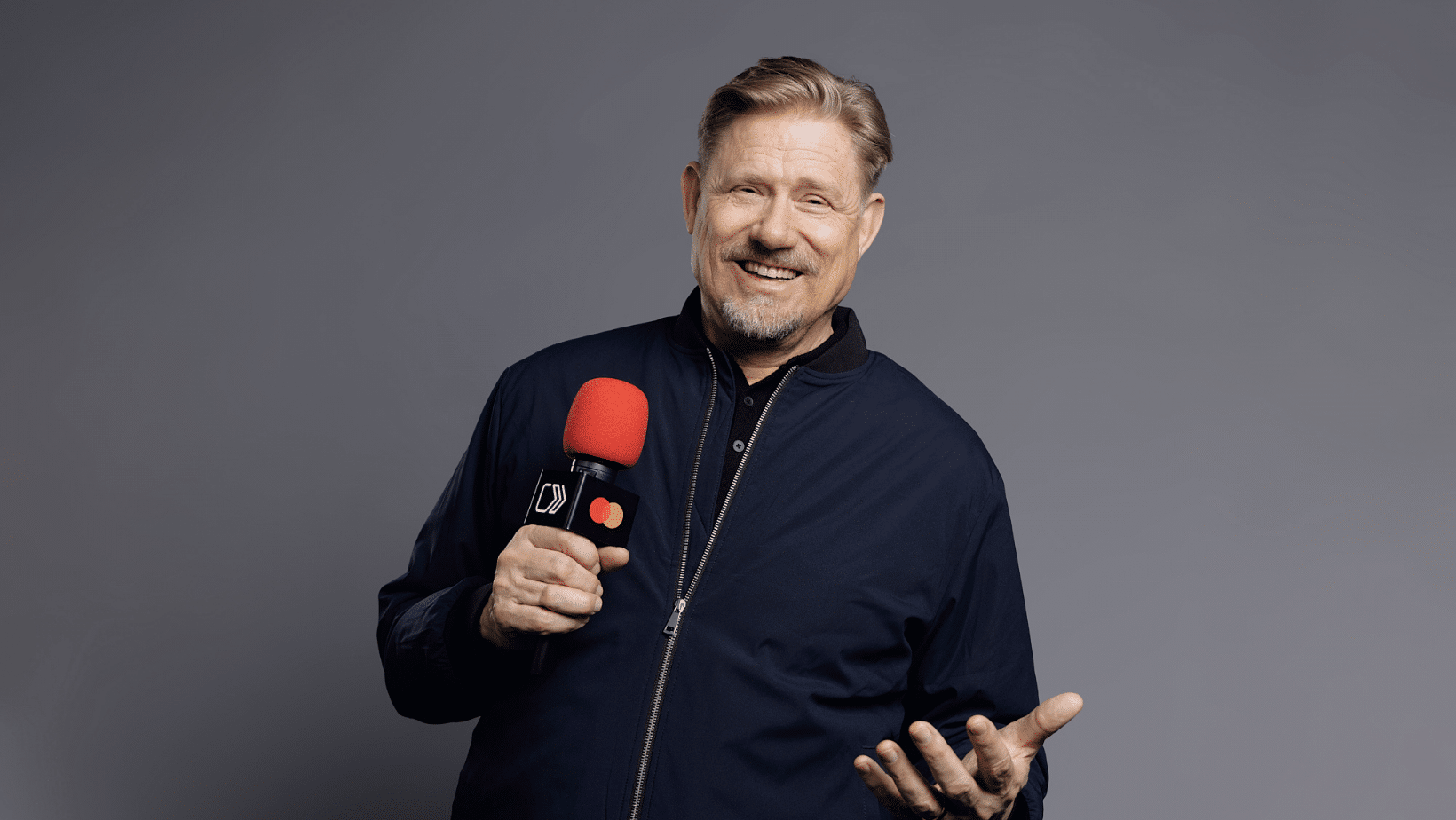

Mastercard has teamed up with goalkeeping legend Peter Schmeichel to help accelerate the UK’s shift to Click to Pay, a more secure, faster and simpler way to buy online.

In a new film, the former Man Utd and Denmark keeper encourages Brits to embrace the new payment method, where passkeys, biometrics and trusted devices replace passwords and long card numbers. It comes as new Mastercard research reveals the UK is home to Europe’s most safety‑conscious online shoppers, with 82%1 using biometrics and other security features such as one-time passcodes and chargebacks for unauthorised purchases.

The study also shows that Brits are ahead of the game on e-commerce – with consumers doing more than a quarter of their spending online (28%)2 against a European average of 22% – while more than half (55%) regularly use digital payment methods such as digital wallets and open banking1.

Mastercard is halfway towards its 2030 goal of phasing out manual card entry online across Europe and moving to payments based around a process called tokenisation. For Click to Pay, this means UK shoppers will no longer have to enter their 16-digit card number when paying online – something 9 in 10 revealed they had done last year3 – and these details will no longer be shared with merchants. Instead, the transaction will be represented by a secure digital token – meaningless if stolen – and consumer payments can be authorised with a one-time passcode, passkeys or biometrics.

“The future of payments should feel more like a tap‑in, not an overhead kick,” said Peter Schmeichel. “Click to Pay means no more fumbling for cards or mistyping numbers — just a smooth, secure way to buy online.”

“UK shoppers are already leading the way in payment security, and this will help us transition to faster, more intuitive and more secure ways to pay,” said Simon Forbes, Division President, UK and Ireland at Mastercard. “Those who move now will help shape a more seamless digital payments experience for the decade ahead.”